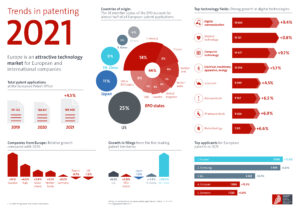

The European Patent Office (EPO) received 188 600 applications in 2021, up 4.5% on the previous year and the highest number to date, according to the EPO’s Patent Index 2021. Patent filings rebounded after a slight dip in 2020.

“Digital communication (+9.4% compared with 2020) narrowly overtook medical technology (+0.8%) as the field with the largest number of European patent applications in 2021. Computer technology was the third strongest field, and the one with the steepest growth (+9.7%) among the top ten. The related fields of audio-visual technology (+24%) and semiconductors (+21%) saw unprecedented growth, albeit from a smaller base. The big increase in patent applications in digital technologies demonstrates the digital transformation, for example in smart urban mobility. Patent activity in pharmaceuticals (+6.9%) and biotechnology (+6.6%) also continued to boom, underlining high levels of innovation in vaccines and other areas of healthcare.”

As the EPO index sets out, the top five countries of origin for applications in 2021 were again the US – accounting for 25% of total filings – followed by Germany (14%), Japan (11%), China (9%) and France (6%). Patent applications are highly concentrated in a few countries, with five countries accounting for 64% of European patent applications in 2021, and the top 20 countries accounting for 95%. The growth in patent applications at the EPO in 2021 was mainly fuelled by filings from China (+24% compared with 2020) and the US (+5.2%). The share of applications from Europe continued to decline, falling from 50% of the total in 2013 to 44% in 2021.

Huawei was the leading patent applicant at the EPO in 2021 (as in 2019), followed by 2020’s leader, Samsung, and LG. The top ten includes four companies from Europe, two from South Korea, two from the US, and one from each of China and Japan.

According to the EPO index 2021, a significant proportion of applicants are smaller entities: last year, one in every five patent applications to the EPO originating in Europe came from an individual inventor or small or medium-sized enterprise (fewer than 250 employees), and a further 5% came from universities and public research organizations.

________________________

To make sure you do not miss out on regular updates from the Kluwer Patent Blog, please subscribe here.

Do you have any idea what proportion of these “European applications” and PCT filings which never enter the regional phase?

Non-entering applications are not counted; from the “European patent applications” section: “European patent applications include direct European applications (Direct) and international (PCT) applications that entered the European phase during the reporting period (PCT regional).”

The only quality criterion is apparently timeliness.

I could not find any statistic on opposed patents and the result of the opposition.

Is there any reason for this absence?

More work coming in, yet the amount of examiner posts is continuously decreased…..

So much for allocating an increasing amount of resources for “quality”….

This just means more limit dates to pressure the employees more…..

Sorry, I’m seeing myself out.